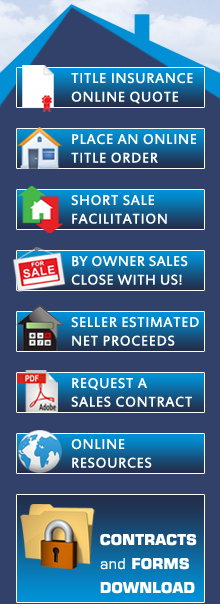

The Senate Finance Committee has passed a two-year retroactive extension of tax relief for households who’ve had mortgage debt forgiven by a lender as part of a short sale or loan modification.

“We applaud the Senate Finance Committee for approving a bipartisan compromise bill today,” NAR President Steve Brown says. The legislation still needs to be passed by the full Senate and also by the House.

The issue has been one of NAR’s top legislative priorities since 2007, when the association worked with lawmakers to enact the relief into law and also later to encourage them to extend the relief in 2008 and 2012.

The relief expired at the end of last year, and unless the full Senate and House approve the extension, households will face the prospect that when they file their returns next year, they’ll pay tax on so-called phantom income, which is the amount of debt forgiven. Absent the provision, the tax law provides that such forgiven debt is income.

“This is, at its core, an issue that’s all about fairness,” Brown says. “It is unfair to ask homeowners who are underwater on their mortgage and who make the prudent decision to do a short sale instead of allowing their mortgage to go into foreclosure to pay tax on the forgiven amount of the loan.”

Brown says the tax hit encourages owners to walk away rather than sell their house, which hurts neighborhoods and the communities they’re in.

The tax relief provided in the past has been one of Congress’ bipartisan success stories, and there’s a good chance an extension will pass Congress this year, too, analysts say.

Some 350,000 households could be affected by the tax if relief isn’t extended, because that’s the number of households who sold their house last year as a short sale. “And we expect a large number of short sales [an estimated 300,000 to 350,000] this year,” says Brown.

Those numbers suggest that there remains a great need for the tax relief, even though housing markets around the country are much improved from where they were at the height of the housing slowdown. “The need is still clearly there,” Brown says.

To help make its case, NAR has joined with about two dozen consumer, real estate, and other groups to run a forceful ad in key publications that educates lawmakers about the continuing need for relief. “Upside-down homeowners need tax relief now,” the ad says.

The legislation passed by the committee also extends the 15-year cost recovery for qualified leasehold improvements and a provision that lets taxpayers expense certain qualified real property. The bill also extends the deduction for energy efficient commercial buildings.

Thank you: REALTOR®Mag